The most Accurate

GST Calculator in Australia

With GST

GST Amount

Total Amount

Without GST

Base Amount

GST Removed

Welcome to our GST Calculator Australia homepage, your one-stop solution for quick and accurate Goods and Services Tax calculations. Our tool is embedded right on this page, providing real-time results in a user-friendly format. Whether you’re a business owner tracking taxes or a shopper checking prices, our calculator ensures you get instant, error-free GST calculations with minimal effort. In this guide, we’ll not only help you use the calculator step-by-step, but also cover everything you need to know about GST in Australia in a natural, conversational tone.

We’ve combined and improved on the content from top GST calculator sites to make this the most complete and authoritative GST resource online.Below, you’ll find sections explaining what GST is, who needs to register or pay it, how to add or subtract GST from amounts, GST-free items, GST on imports, how GST returns and credits work, common mistakes to avoid, real-life examples, FAQs, and more. Let’s dive in and make the GST calculation simple and stress-free for you!

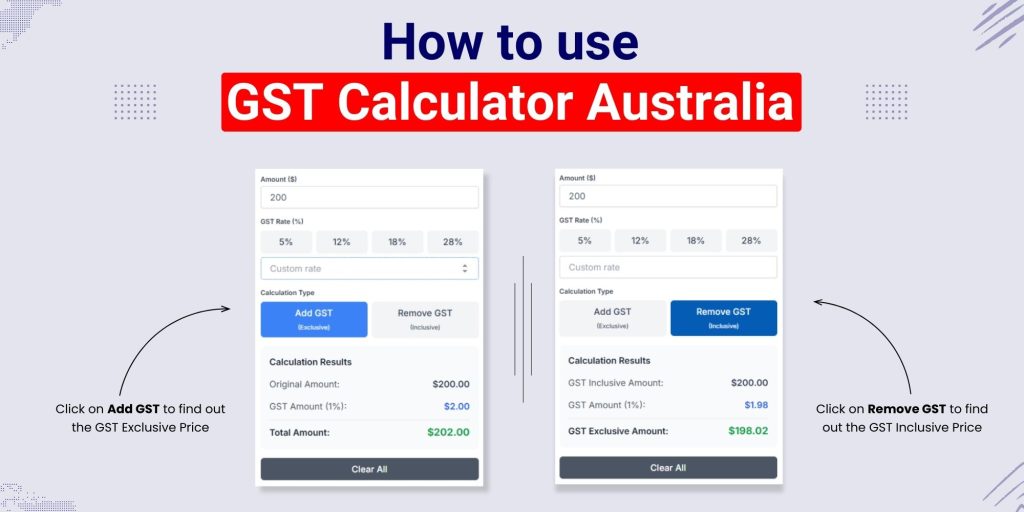

How to Use the GST Calculator (Step-by-Step)?

Using our GST calculator is super simple. Just follow these steps:

Enter the Amount:

Input the price or amount in Australian dollars into the “Enter Amount” field of the calculator. This can be a price before GST or a price that already includes GST; we’ll handle both scenarios. (By default, our calculator assumes amounts exclude GST, but you can easily calculate the GST portion of an inclusive price by choosing the subtract option in the next step.)

Set the GST Rate (if needed):

The standard GST rate in Australia is 10%, which is pre-filled in the “GST Rate (%)” field. You can leave it at 10 for Australian calculations. If you need a different rate (for example, checking GST for another country or a hypothetical change), you can adjust this percentage. Our tool isn’t limited to 10%, it works for any GST or VAT rate.

Choose Add or Subtract GST:

Click the “

Add GST” button if you want to add 10% GST to a net price (i.e. calculate the gross price including GST). Click “

Remove GST” if you have a price that already includes GST and you want to subtract the GST to find the base price without tax. The calculator will instantly display the results for both scenarios after the first calculation – showing you the GST amount and the new price, either inclusive or exclusive of GST.

View Instant Results:

Once you press the add or subtract button, you’ll see the outcomes immediately on the page. Our calculator will show the GST Amount (the tax portion) as well as the total price, including GST if you added it, or the price excluding GST if you removed it. Results update in real time as you type or change inputs, so you can tweak numbers on the fly without needing to hit “Calculate” every time.

Copy or Reset (Optional):

Need to use the result elsewhere? Simply click the “Copy” button next to the result to copy the number to your clipboard (no manual highlighting needed). If you want to start over, hit “Reset” to clear the fields.

That’s it! Our interface is designed for speed and simplicity. Enter an amount, choose your calculation, and get answers instantly. No more second-guessing or manual percentage math. Go ahead and try the GST calculator above now with an amount of your choice to see how easy it is.

(Tip: The tool works on mobile devices as well, so you can calculate on the go. It’s free to use and requires no sign-up.)

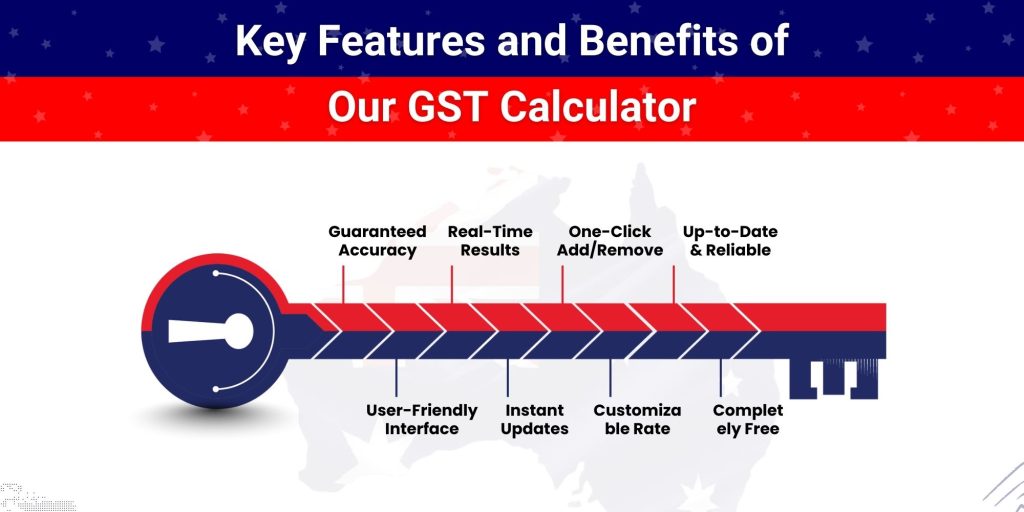

Key Features and Benefits of Our GST Calculator

Our GST calculator comes packed with features that make it stand out as the most reliable option for Australian GST calculations. Here’s why you’ll love using it:

Guaranteed Accuracy:

The calculator uses precise formulas and has been tested against official sources, so you can trust the results to be correct every time. No more worrying about manual calculation errors or typos.Simple, User-Friendly Interface:

We’ve designed the tool to be clean and intuitive. Even if you’re not a “numbers person,” you’ll find it easy to enter your amounts and get the information you need without confusion.

Instant, Real-Time Results:

Save time with calculations that appear immediately. After the first input, every adjustment updates the GST-inclusive and GST-exclusive values automatically as you type. It’s a fast, interactive experience no page reloads required. Discover more about in this informative blog: “GST-inclusive and GST-exclusive Pricing “

Add or Remove GST with One Click:

The calculator handles both inclusive and exclusive GST calculations. Whether you need to add 10% to a net price or find the pre-GST amount from a gross price, our GST tool gives you both answers with a single click.

Customizable Rate:

While it defaults to Australia’s 10% GST, you can input any percentage. This is useful if GST rates change or if you’re comparing tax rates in other countries (e.g. New Zealand’s 15% GST or UK VAT). The calculator isn’t limited to one rate – it’s flexible for various needs.

Reliable and Up-to-Date:

We regularly update the tool according to the latest tax rules. The underlying data and formulas are aligned with Australian Taxation Office guidelines, ensuring precise results based on current laws.

Free of Cost:

Our GST calculator is completely free to use, with no hidden fees or paywalls. It’s here to help individuals and businesses make informed decisions without any extra expense.

By focusing on accuracy and ease of use, our goal is to take the stress out of GST calculations. You can confidently rely on this tool for everything from business invoicing to personal budgeting, knowing it’s been designed with your convenience in mind. Now, let’s cover some essential background about GST itself, so you fully understand the numbers the calculator provides.

What is GST (Goods and Services Tax)?

Goods and Services Tax (GST) is a broad-based value-added tax of 10% applied to most goods, services, and other items sold or consumed in Australia. In other words, when you buy most products or services, 10% of the price goes to the government as GST. GST was introduced on 1 July 2000 by the Australian government (under Prime Minister John Howard) as part of a major tax reform, replacing several previous taxes. Since its introduction, the GST rate has remained at 10%, making it one of the lower value-added tax rates worldwide.

One key feature of GST is that it’s a multi-stage tax – charged at each step of the supply chain – but ultimately it is only borne by the end consumer. Businesses intermediate in the supply chain collect GST on their sales and pay GST on their inputs, but they can claim back (credit) the GST they paid so that the tax isn’t a cost to them. This way, the tax “flows through” businesses and is finally paid by the consumer who buys the final product or service. For consumers, GST simply means an extra 10% is usually included in the retail price of taxable goods and services.

To clarify, GST applies to the vast majority of everyday purchases – from clothes and electronics to restaurant meals and professional services. However, some categories are exempt or “GST-free” (we’ll cover those specific exceptions in a later section). Overall, GST has broadened Australia’s tax base, and nearly every business has to incorporate GST into its pricing and invoicing.

In summary, GST is a 10% tax on most goods and services in Australia, paid by consumers at the point of sale. It’s collected by registered businesses on behalf of the government. Because businesses can claim GST credits on their costs, the tax is structured so that revenue is generated at each sale but the economic burden falls only on final consumers. Now that you know what GST is, let’s look at who needs to register for GST and the obligations involved. To know more about 10% GST read this blog.

Who Needs to Register for GST (and Who Pays It)?

GST is ultimately paid by consumers, but businesses are the ones responsible for collecting and remitting it to the government. If you are buying something as an individual, the price you pay usually already includes GST (unless it’s a GST-free item). You won’t need to do anything extra – the seller will take care of the tax portion. Businesses, on the other hand, have to decide whether they need to register for GST and charge it on their sales. Here’s what you need to know:

GST Registration Threshold:

In Australia, any business or sole trader must register for GST once their annual gross income (turnover) reaches AUD $75,000 or more in any 12-month period. This threshold is higher for non-profit organizations – they must register once turnover hits $150,000 or more per year. Importantly, certain businesses have to register for GST regardless of turnover: for example, if you drive a taxi or rideshare (Uber, etc.), you are required to register for GST from day one, no matter how much you earn. Also, businesses wanting to claim fuel tax credits need to register for GST as a prerequisite.

Voluntary Registration:

If your business turnover is below the threshold (e.g. a side business earning less than $75k/year), you can choose to register for GST voluntarily but it’s not compulsory. By registering voluntarily, you’ll be able to charge GST and claim back GST credits on your purchases (more on GST credits in a moment). Some small businesses do this if they have significant expenses, as it can actually improve their net profit in certain cases. However, it also means extra paperwork (like filing GST returns). So you should weigh the pros and cons for your situation.

Obtaining an ABN:

To register for GST, your business will need an Australian Business Number (ABN). Once you have an ABN, you can register for GST online through the ATO’s Business Portal or by phone, or with the help of a tax/BAS agent. After becoming eligible (hitting the threshold), you are expected to register within 21 days to stay compliant. Delaying registration beyond that when required can lead to penalties and interest charges.

Penalties for Not Registering:

If a business that is required to register for GST fails to do so, there can be serious consequences. The ATO can retroactively charge you GST on your sales from the date you were required to register. In effect, you’d still owe 1/11th of all sales you made after crossing the threshold (since 1/11 of a GST-inclusive price represents the 10% tax) plus potential interest and penalties. In short, you don’t get to avoid the tax by not registering – you’ll end up paying it later out of your revenue, which can be a big hit to your finances. It’s far better to register on time and simply include GST in your prices so your customers bear the cost, not you.

Now, who actually pays GST in the end? It’s the consumer. GST is designed so that businesses act as tax collectors. Businesses add 10% to their prices (when they are registered and the sale is taxable) and collect that extra from customers. They then periodically send that money to the ATO through their GST returns (BAS), often confirming figures using a GST Calculator for accuracy. If you’re a consumer, you “pay” GST as part of the price of things you buy. If you’re a business, you collect GST from your customers, but you also pay GST on your business purchases; you’ll remit only the net difference (GST on sales minus GST on purchases) to the ATO. This mechanism ensures that only the final consumer effectively pays the full 10% tax. If you want to know more about GST Registration read this article.

Business Obligations After Registering

When your business is registered for GST, there are a few important obligations to manage going forward:

Charge GST on Sales:

You must add 10% GST to the price of most goods and services you sell (unless they are GST-free). For example, if an item is $100 net, you’d charge $110 including GST. In practice, many businesses quote prices as “including GST” to consumers for simplicity.

Issue Tax Invoices:

Your invoices/receipts to customers should show the GST amount or a statement that the total price includes GST. This is required for transparency and for your business clients to claim credits. Update your invoice templates to ensure GST is clearly included.

Lodge BAS Statements:

You’ll need to lodge a Business Activity Statement (BAS) either quarterly or monthly (depending on your reporting cycle) to report the GST you’ve collected and the GST you’ve paid on business purchases. We’ll explain how to calculate these in the “GST Returns and Payments” section below. Timely BAS lodgement and payment of any GST due is essential to avoid fines.

Keep Records & Receipts:

Maintain proper records of all sales and purchases. Keep copies of tax invoices for your business purchases because these serve as evidence for the GST credits you claim back. Good record-keeping will support your BAS filings and protect you in case of an audit.

By fulfilling these obligations, you’ll remain compliant with GST law and ensure your customers are correctly charged. It may seem like extra work, but our GST Calculator tool above can lighten the load by helping with the necessary calculations (e.g., figuring out how much GST to add or how much of a price is GST). Next, let’s look specifically at those calculations on how to add or subtract GST, which is something our GST Calculator can do instantly.

How to Calculate GST in Australia?

(Adding or Subtracting 10%)

Calculating GST manually can be done with a couple of straightforward formulas. The method differs slightly depending on whether you are adding GST to a net price or removing GST from a gross price. Below, we break down both scenarios with formulas and examples. You’ll also see a common mistake people make and how to avoid it.

How to add GST to a Price?

If you have a price that does not include GST yet (often called the net or GST-exclusive price) and you need to add 10% GST to find the total cost to the customer, you can quickly work it out using a GST Calculator.

- GST Amount: Multiply the original price by 0.10 (which is 10%). This gives the amount of GST to add. For example, for a product priced at $1,000 (before tax), GST = $1,000 × 0.1 = $100.

- GST-Inclusive Price: Add the GST amount to the original price. In formula terms, multiply the original price by 1.1 (which effectively adds 10%). Using the above example, $1,000 × 1.1 = $1,100. So $1,100 is the price including GST.

Another way to express these calculations is by using percentage formulas:

- GST amount = Original Price × (GST rate / 100) = Original Price × 10% (for Australia’s rate).

- GST-inclusive price = Original Price × (1 + GST rate/100).

For instance, at 10% GST: if the net price is $100, the GST amount is $100×10% = $10, and the gross price becomes $100 + $10 = $110. Our calculator performs these additions instantly for you, so you don’t have to do the math each time.

How to subtract/remove GST by Using a GST Calculator?

If you have a price that already includes GST (a gross or GST-inclusive amount) and you need to find the underlying net price and the GST component within it, you can easily determine this using a GST Calculator.

GST Component

Divide the total price by 11. Why 11? Because the total price is 110% of the net (100% original price + 10% GST). Dividing by 11 effectively gives you the value of the 10% portion. For example, if a service costs $1,100 (GST included), dividing $1,100 by 11 yields $100, which represents the GST in that amount. (Check: $1,100/11 = $100, so $100 GST was included.)GST-Exclusive Price:

Divide the gross price by 1.1. This gives the original price before GST was added (since gross = net×1.1, net = gross/1.1). Using the $1,100 example: $1,100 ÷ 1.1 = $1,000, which should be the net price before tax. You can also get the same result by taking the gross price and subtracting the GST component we found: $1,100 – $100 = $1,000.

Equivalently, formulas for reverse calculations are:

- GST amount = Gross Price × (GST rate / (100 + GST rate)). For 10%, that’s Gross × 10/110. Indeed $1,100 × (10/110) = $100.

- GST-exclusive price = Gross Price × (100 / (100 + GST rate)). For 10%, that’s Gross × (100/110). E.g. $1,100 × (100/110) = $1,000.

Our advanced calculator handles these reverse calculations with ease – just use the “Subtract GST” option and it will output the net figure and the GST portion in one go. This saves you the hassle of remembering the 1.1 or 11 divisors. To understand GST removal better, read our blog “How to remove GST“.

Avoid This Common GST Calculator

Mistake while calculating!

- Incorrect approach: A product costs $220 including GST. One might erroneously assume the pre-GST price is $220 – 10% = $198. This is wrong – $198 is not the original price.The correct method is to divide by 1.1 (or by 11 for the GST portion). Let’s illustrate using the above number:

-

Correct approach:

For a $220 item (incl. GST), the GST portion is $220/11 = $20, and the net price is $220/1.1 = $200. Indeed, $200 + $20 GST = $220. The mistake in the “subtract 10%” method is that 10% of $220 ($22) is not the same as the 10% that was originally added. Always use the divide-by-1.1 (or divide-by-11) approach to reverse out GST, not a flat 10% subtraction.

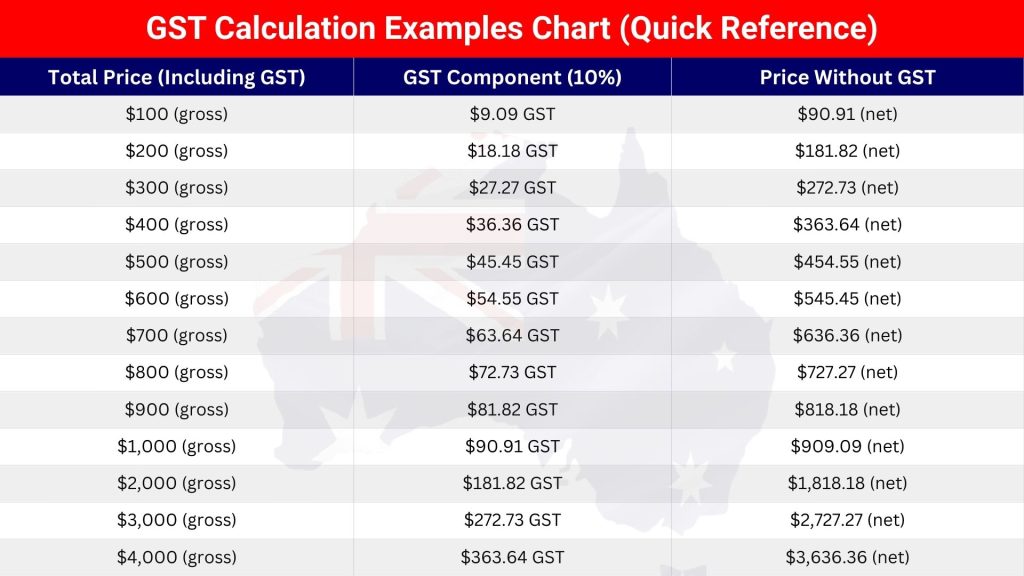

GST Calculation Examples Chart (Quick Reference)

Sometimes it helps to see the GST calculations for example amounts to fully grasp the concept. Below is a quick reference table showing prices with GST vs without GST for some common values. This assumes the standard 10% GST rate in Australia:

(For any odd amounts or those not listed here, you can always use the GST calculator above to get the precise breakdown. For example, for a $2433 purchase, it’s quicker to plug it into the calculator than to do the long division!)

From the table, notice the pattern: the GST portion is always one-eleventh of the gross price (because 1/11 ≈ 0.0909, which is 9.09% of the gross). And the net price is always 90.91% of the gross. This aligns with the formulas we discussed, and you can verify these figures instantly using a GST Calculator. You can use these examples as a sanity check for your own calculations.

Now let’s move on to GST exemptions not everything in Australia is taxed, and it’s important to know which items are GST-free.

GST Rounding Rules in Australia:

GST rounding rules in Australia ensure consistency when calculating tax on invoices and receipts. The ATO allows two main approaches: rounding at the line item level or rounding only the total invoice amount. In both methods, amounts must be rounded to the nearest cent, with 0.5 cents always rounded upwards. For example, if GST works out to $2.475, you record it as $2.48. Most accounting software like Xero and MYOB automatically apply these rules, but businesses should understand the difference between line-by-line and total rounding to stay compliant and avoid discrepancies in BAS reporting. For GST Rounding Rules explaination read this blog: “GST Rounding Rules in Australia: Line Items vs Totals“

GST-Free Goods and Services in Australia

Australia exempts certain goods and services from GST, meaning no 10% tax is added to their price. These exemptions generally cover essential products and services or special categories. If an item is GST-free, consumers don’t pay GST on it and businesses don’t charge GST (but businesses can usually still claim credits for any GST they paid on inputs related to these sales). You can also use a GST Calculator to confirm whether GST should apply or to verify pricing for exempt items. Here are some key GST-free categories:

GST-Free Products

Basic Food:

Most essential food items are GST-free. This includes fresh produce like fruits and vegetables, meat, bread, milk, and eggs. (Processed or prepared foods may not be exempt, but basic staples are not taxed to keep groceries more affordable.)

Healthcare Products:

Certain medical supplies and aids are GST-free. For example, prescription medicines, some medical devices, and menstrual products are not subject to GST. These exemptions aim to reduce healthcare costs.

Disability & Health Aids:

Appliances or aids for people with disabilities (e.g. wheelchairs, hearing aids) can be GST-free. Also, cars or vehicles that are specially modified for disabled use may be exempt.

Educational Materials:

Course textbooks and certain educational materials can be sold GST-free in some cases (though the education services themselves are discussed below).

Precious Metals & Bullion:

Supplies of investment-grade gold, silver, and other precious metals are GST-free.

Farm Land & Exports:

Sales of farmland and exports of goods out of Australia are generally GST-free. Exported goods aren’t consumed domestically, so they’re not taxed.

(There are more specific items in the GST-free list, but the above are among the most commonly encountered products.)

GST-Free Services

Health Services:

Many medical and health services are exempt from GST. Visits to the doctor, many hospital treatments, and other healthcare services (provided by a registered practitioner) are typically GST-free.

Educational Services:

School and university courses, and related excursions or field trips, are GST-free. This includes course tuition fees. Child care services are also GST-free, making education and care more accessible.

Childcare:

As mentioned, most childcare services (provided by approved carers or centres) do not charge GST.

Religious & Charitable Services:

Services provided by religious institutions (like worship services) and many activities of charities are GST-free when delivered for nominal or no fee.

Water and Sewerage:

Supplies of water, as well as sewerage and drainage services, are GST-free essentials.

International Transport:

International airfares or international transport of goods is GST-free (since the consumption is considered to take place outside Australia for the most part). Also, tickets sold for overseas travel don’t include GST.

Residential Rent and Sale of Existing Homes:

While not listed above, it’s useful to know that residential rents are input-taxed (no GST charged to tenant, but no credits for landlord) and sales of existing residential properties are generally not subject to GST (only new developments are). If you’re unsure about GST treatment in such cases, a GST Calculator can help confirm amounts and ensure your figures are accurate.

GST on Imported Goods (for Individuals vs. Businesses)

When importing goods into Australia, GST can apply depending on the circumstances. The rules differ for private consumers (individuals) buying from overseas and for GST-registered businesses importing goods.

For Individual Shoppers (Low-Value Imports)

If you’re a private individual purchasing goods from overseas for personal use, there is a concept of low-value import threshold. Goods valued at under AUD $1,000 were traditionally considered low-value imports. Prior to 2018, such imports were not charged GST at the border. However, Australia updated its laws so that overseas vendors are now required to collect GST on low-value goods sold to Australians if the vendor has a high turnover. You can use a GST Calculator to estimate the tax payable on such imports and understand the total landed cost before purchasing.

In practical terms: if you buy, say, a phone case online from overseas for $20 plus $5 shipping, you likely won’t pay GST on it at the border. If the overseas seller is big (like Amazon), they might add 10% at checkout due to Australian GST laws. But you as an individual won’t have to pay anything extra when the package arrives, as long as the total value is under $1,000 and/or GST was handled at sale. Australian Customs generally only intervenes for imports above $1,000 (and for those, they will require payment of GST and duty before release).

So, small online purchases (under $1k) for personal use typically include GST in the price if required, or are effectively GST-free to the consumer if the seller isn’t registered. There’s also a minor rule: if the calculated GST and duty on a shipment would be under $50, customs may not bother collecting it. In summary, most individual shoppers buying low-value items from overseas won’t directly pay GST to customs. The GST, if applicable, is usually embedded in the price charged by larger overseas retailers. (Example: You order a $50 gadget from overseas. It arrives with no extra charges because it’s under $1000. If the seller was required to collect GST, it was already included. Otherwise, you got it effectively GST-free.)

For Businesses (Importing Goods for Resale)

If you’re a GST-registered business importing goods (for example, stock for your store or equipment for your business), the situation is different. Businesses will usually pay 10% GST on imports regardless of value (if the goods are taxable). When your shipment arrives in Australia, customs will assess its value (which includes the cost of goods, plus any customs duty, plus shipping and insurance costs).

You’ll have to pay 10% of that total as GST to get the goods released, if the overseas supplier hasn’t already charged Australian GST. Using a GST Calculator can help you quickly estimate this amount before your goods arrive. The good news is that because you’re GST-registered, you can claim back this import GST as a GST credit on your next BAS (effectively getting a refund for it, since the item is for resale/business use).

For example, let’s say you import a bulk order of clothing for resale: the goods cost AUD $30,000. Shipping and insurance are $2,000, and suppose there’s a customs duty of $1,500. The total value for GST would be $33,500. The GST on import would be $3,350 (which is 10% of $33,500) that you must pay to customs. You would then stock these goods and later sell them with GST to your customers. On your BAS, you’d report the GST collected from sales, and you’d claim back the $3,350 as a credit (reducing your GST payable). In essence, you don’t lose that money; it’s just a part of the tax flow.

One important thing: if you’re importing goods for business, ensure you keep all documentation (invoices, bills of lading, etc.). You’ll need proof of the GST paid at import to claim your input tax credit. Usually, customs will provide an import declaration or receipt showing the GST.

(Note: The rules changed in recent years so that more overseas purchases include GST. Large foreign sellers or online marketplaces charge GST on low-value goods at point of sale now. But as a business, you’d likely be importing larger shipments where you handle the import process and GST. When in doubt, consult the ATO or a customs broker for specifics on import GST.)

In summary, individual consumers generally don’t face GST on low-value imports directly, whereas business importers will pay GST on imports but can later recover it as a credit. A GST Calculator can help both consumers and businesses quickly estimate potential GST costs before purchase or import. Now, let’s move on to how businesses report and pay GST, and how GST credits work in that context.

GST Returns and Payments (BAS Reporting)

If you’re a GST-registered business, you need to report and pay GST to the government regularly, usually via the Business Activity Statement (BAS). This process essentially calculates how much GST you owe after subtracting any credits for GST you’ve paid on business purchases. Here’s a step-by-step guide to how GST returns and payments work, with a real-life example:

-

Calculate GST Collected on Sales (Output GST):

Add up all the GST you have charged and collected from your customers on your taxable sales for the period. Every sale you made that included GST contributes to this total. For example, if you sold goods totalling $5,500 (including GST) in a quarter, the GST portion of that would be $5,500 ÷ 11 = $500 in GST collected. (This works because $5,500 gross contains $500 GST; equivalently, it’s 10% of $5,000 net sales.) Do this for all sales and sum the GST amounts, or simply take your total GST-inclusive revenue and divide by 11.

- Calculate GST Paid on Purchases (Input GST Credits):

Next, total up the GST you paid on business purchases, expenses, and costs during the period (excluding any GST-free items). This is the GST on your supplies, inventory, equipment, services, etc., that are used in your business, for which you have tax invoices. For example, say you bought office supplies and equipment totalling $2,200 (including GST) in the quarter. The GST included in those purchases is $2,200 ÷ 11 = $200 in GST paid out. You can use a GST Calculator to quickly work out these amounts for multiple purchases. Again, perform this calculation across all your business purchases that had GST, and sum up the GST paid. - Determine Net GST Payable or Refundable:

Subtract the total GST paid (step 2) from the total GST collected (step 1). The difference is what you owe to the ATO or what the ATO owes you. Using our example numbers: GST collected $500 GST paid $200 = $300. This would be your GST payable for the quarter. You would report these figures on your BAS, and $300 is the amount you’d need to remit to the ATO.

If the result is positive (collected > paid), you owe that amount as GST payment. If the result is negative (you paid more GST on purchases than you collected on sales, which can happen in a slow sales period or if you bought a lot of assets), you are entitled to a GST refund from the ATO for that period.

Example Recap:

You collected $500 in GST from sales and paid $200 in GST on purchases, so you owe $300 to the government. This $300 effectively represents the GST on the value you added in your business (you collected 500, but 200 was already paid out to your suppliers, so the government only asks for the difference). Most businesses file their BAS quarterly, meaning every three months you’d repeat this calculation and pay any GST owed. Some larger businesses file monthly. There’s also an option for smaller businesses to file annually in some cases. The BAS form will have boxes to fill in for “GST on sales” and “GST on purchases”, among other tax info.

Important:

Always keep proper records (invoices, receipts) to substantiate the GST amounts. You can only claim GST credits (GST on purchases) if you have valid tax invoices for expenses over $82.50. It’s also wise to set aside the GST portion of each sale in a separate account so you’re not caught short when it’s time to pay the BAS. Our GST calculator can assist you in figuring out amounts for invoices or bills. For instance, if you need to know how much of a $1,100 invoice is GST to claim the credit, just use the “Subtract GST” function. But for the BAS, you’ll be totalling up all invoices anyway.

In the next section, we’ll look more closely at GST credits themselves a crucial concept that we’ve touched on but deserves its explanation.Read our BAS GST guide for step-by-step information.

GST Credits (Input Tax Credits)

What They Are and How to Claim Them?

A GST credit, also known as an input tax credit, is essentially a refund or credit for the GST a business has paid on goods or services it purchased for use in the business. This mechanism is what prevents GST from being a cost to businesses and confines the tax to the end consumer. When your business is registered for GST, for every expense you incur where the price includes GST (such as stock, supplies, equipment, or even services like advertising, provided the supplier charged you GST), you are entitled to claim that GST amount back. These credits are claimed on your BAS and reduce the overall GST you have to pay for the period. It’s why, as we explained earlier, businesses calculate net GST by subtracting these input credits from the GST collected on sales.

For example, if your business buys a new laptop for $1,100 (including $100 GST), you can claim the $100 as a GST credit. If in the same period you sold some goods and collected $100 GST from customers, the $100 credit on the laptop purchase would offset that, and you’d owe nothing to the ATO (because $100 – $100 = $0). You can easily verify these figures using a GST Calculator Australia to ensure accuracy. Essentially, you got back the GST you paid on the laptop. This ensures that the laptop’s GST isn’t a cost to your business the cost is passed on to your customers when you sell your goods/services.

Key points about GST credits:

- You must be GST-registered to claim GST credits. If you’re not registered, any GST you pay on purchases just becomes part of your costs (you can’t reclaim it). The purchase must be used for your business (at least partly). If something is used partly for private use, you can only claim the proportion related to business use. You need a tax invoice from the supplier for purchases over $82.50 that shows they charged you GST, to legally claim the credit.

- Some purchases won’t have GST (e.g., GST-free items or purchases from very small suppliers not registered for GST). Naturally, you can’t claim credits for GST you never paid. You claim the credits in the BAS period when you received the invoice or made the payment (assuming you account for GST on an accrual or cash basis accordingly).

- The net effect of GST credits is that GST is neutral for businesses for their inputs. You only pay the net GST on the value you add. As a result, only the final consumer in the chain bears the GST cost. This is exactly how the GST system is intended to work. One strategic implication: as mentioned earlier, even businesses under the $75k threshold might choose to register for GST so they can claim GST credits.

- For instance, if your turnover is $60k and you have $40k of GST-inclusive expenses, being able to reclaim the GST on $40k (which is roughly $3,636) could boost your profits, even though you’d then charge GST on your $60k sales. You’d collect $6,000 GST on sales, claim $3,636 on purchases, and only pay net $2,364, allowing you to lower costs or increase margins.

- A GST Calculator Australia can quickly confirm these figures and help you weigh the financial benefits. The example from one of our competitor analyses showed that a small business ended up with a higher net operating profit by registering for GST and claiming credits, despite having to charge GST to customers. So it can be beneficial if your customers don’t mind the GST (for example, if they are mostly other businesses that can claim it too).

In short, GST credits are your friend as a business; they prevent double taxation and improve cash flow on your inputs. Just keep those receipts and be diligent in claiming them on your BAS. Now, let’s address some frequently asked questions about GST and using the calculator:

Frequently Asked Questions (FAQs)

How much GST in Australia?

The GST rate in Australia is 10% of the price of most goods and services. This rate has been unchanged since it was introduced in 2000. That means for every $1.00 of pre-GST price, you’ll pay $0.10 in tax, making the total $1.10. In other terms, GST is one-eleventh of a GST-inclusive price. You can use a GST Calculator Australia to quickly apply this formula to any amount. (Note: There has occasionally been public discussion about changing the rate, but as of now it’s still 10%.)

How do you calculate GST in Australia?

To calculate GST, you can use two simple scenarios: 1) For a price before GST: Multiply the amount by 10% (or 0.1) to get the GST, then add it on top for the total. For example, for a $100 item, 10% GST is $10, making the total $110.

2) For a price that includes GST: Divide the total amount by 11 to get the GST portion already included, or divide by 1.1 to get the original price before GST. For example, if the total (incl. GST) is $110, dividing by 11 gives $10 GST, and dividing $110 by 1.1 gives the pre-GST price of $100.

These calculations can be done instantly with our GST calculator – just use “Add GST” for scenario 1 or “Subtract GST” for scenario 2 and the tool will do the math for you.

What is $300 plus GST?

“$300 plus GST” means adding 10% to $300. Ten per cent of 300 is $30. So, $300 + $30 = $330. The total amount, including GST would be $330. In general, the formula is $300 × 1.1 = $330. Our calculator would show $300 net becomes $330 gross, with $30 GST added.

How do I subtract GST from a price?

To remove GST from a GST-inclusive price (to find the base before tax), divide the price by 1.1. This effectively correctly subtracts the 10%. For example, if a product costs $220 including GST, dividing by 1.1 gives $200, which is the price before GST. Another method: divide by 11 to get the GST amount ($220/11 = $20), and then subtract that from $220 to also get $200. In short, “minus GST” involves dividing by 1.1, not simply subtracting 10% of the total.

Do I need to register for GST as a sole trader?

If you are a sole trader (or any form of self-employed individual) in Australia, you must register for GST if your business turnover is expected to be $75,000 or more per year. Additionally, if you drive a taxi or rideshare, you must register regardless of income. If your earnings are below $75k, you don’t have to register, but you may choose to do so voluntarily to claim GST credits. The same threshold and rules apply to sole traders as to other businesses the law doesn’t distinguish based on business structure for GST purposes.

Why do you divide by 11 for GST?

Dividing by 11 is a quick way to find the GST component of a price that already includes 10% GST. Here’s why: when 10% GST is added, the total becomes 110% of the original price (100% + 10%). The GST portion is therefore 10/110 of the total, which simplifies to 1/11 (approximately 9.09%). By dividing the gross amount by 11, you’re essentially extracting the 10% part out of the 110% total. For example, if the price including GST is $110, dividing by 11 gives $10, which is the GST. The remaining $100 is the net price. This trick only works for a 10% tax rate if GST were, say, 15%, we’d divide by 1.15 to get net, etc. But at 10%, the nice divide-by-11 rule is handy, and you can confirm it instantly with a GST Calculator.

Does the “net” price include GST?

No! when we refer to “net” price in the context of GST, we mean the price excluding GST. It’s the amount before the 10% tax is added. Sometimes it’s also called the exclusive or pre-GST price. The price including GST is often called the gross price. For example, if something is $100 net, its gross price with GST would be $110. So if someone asks for a net price, you should quote without adding GST (useful in B2B contexts where the client will add GST themselves). In summary: Net = no GST, Gross = with GST.

How much is GST in Australia?

In Australia, the Goods and Services Tax (GST) is 10%. It applies to most goods, services, and items sold or consumed in the country, with some exemptions like basic food, healthcare, and certain education services.

How do you work out GST?

To calculate GST at 10%, simply multiply the price (excluding GST) by 0.10. For example, a $100 item will have $10 GST, making the total $110.

If you need to find the GST component from a price that already includes GST, divide the total amount by 11.

For example, $110 ÷ 11 = $10 GST.

Add GST” button if you want to add 10% GST to a net price (i.e. calculate the gross price including GST). Click “

Add GST” button if you want to add 10% GST to a net price (i.e. calculate the gross price including GST). Click “ Remove GST” if you have a price that already includes GST and you want to subtract the GST to find the base price without tax. The calculator will instantly display the results for both scenarios after the first calculation – showing you the GST amount and the new price, either inclusive or exclusive of GST.

Remove GST” if you have a price that already includes GST and you want to subtract the GST to find the base price without tax. The calculator will instantly display the results for both scenarios after the first calculation – showing you the GST amount and the new price, either inclusive or exclusive of GST.